us japan tax treaty interest withholding

The applicable WHT rate based on the WHT rates for interest for debt-derivative transactions is applied on a net basis. As a taxpayer filing Form W-8BEN or Form W-8BEN-E these tables will.

China Usa F 1 Tax Treaty Students And Trainees O G Tax And Accounting

If the Treaty Article Citation includes a P that refers to a protocol that amends the treaty article.

. Citizen an additional credit for part of the tax imposed by the treaty partner on US. As a withholding agent you should consult the actual provisions of the tax treaty that apply to the person to whom you are making payment if you have any reason to question the documentation you have received. Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax.

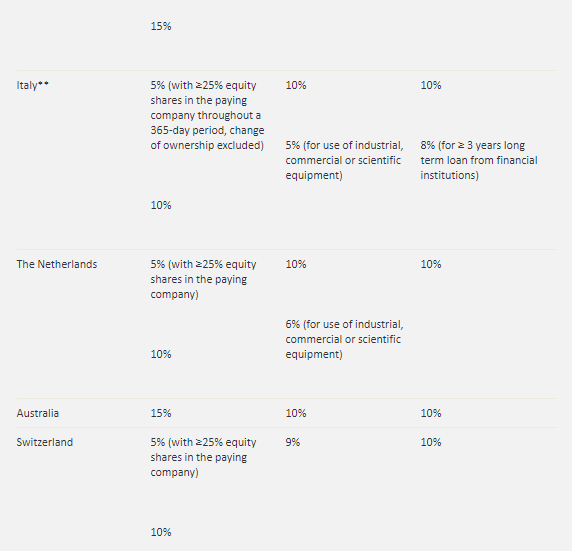

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. However if that belief is later found to be incorrect HMRC may direct that the. The United States is a party to tax treaties designed to prevent double taxation of the same income by the United States and the treaty country.

It is separate from and in addition to your foreign tax credit for foreign taxes paid or accrued on. However if the transaction is liquidated in kind the applicable WHT rate on the same. Certain treaties allow a US.

The tables are not meant to be a complete guide to all provisions of every income tax treaty. When the investor is a resident in a country with which Mexico has signed a tax treaty such withholding will not apply if certain requirements are satisfied. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Summary of US tax treaty benefits. In most cases a net basis tax rather than a reduced tax rate or exemption applies if the income is attributable to a permanent establishment of the taxpayer in the United States under the Business Profits article of the treaty. Source Income Subject to Withholding.

Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying. See also Table 3. Unlike the rule regarding interest where such a relief is available a company may make a royalty payment gross of WHT or subject to a reduced rate of WHT under a treaty without prior clearance having been given by HMRC if they reasonably believe at the time that the relief is due.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Usa India J 1 Tax Treaty Professors Teachers And Research Scholars O G Tax And Accounting

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Should The United States Terminate Its Tax Treaty With Russia

Japan United States International Income Tax Treaty Explained

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Form 8833 Tax Treaties Understanding Your Us Tax Return

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Double Tax Treaties Experts For Expats

Japan United States International Income Tax Treaty Explained

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan Tax Treaty International Tax Treaties Compliance Freeman Law

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Avoiding Double Taxation Expat Tax Professionals

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology