tax avoidance vs tax evasion examples

Web Tax evasion is totally different from tax avoidance. Web Tax Evasion Meaning.

Tax Avoidance Vs Tax Evasion Know The Difference The Business First Network

Tax evasion on the.

. One method to avoid taxes is not paying at all or. Here are some examples of tax evasion. Web The following are the examples of tax evasion.

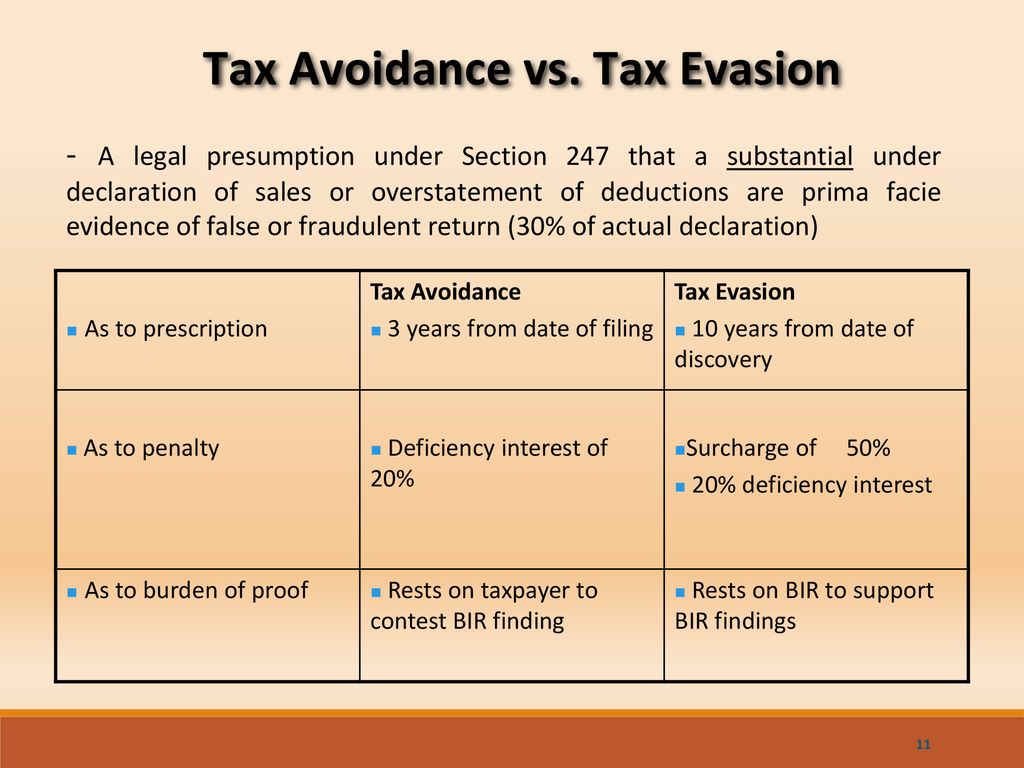

Web Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length. Web Explore millions of resources from scholarly journals books newspapers videos and more on the ProQuest Platform. 1 Ignoring overseas income.

Making a false return of income by omitting or understating income or overstating expenses. Web Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash. For example the money in your RRSP is tax.

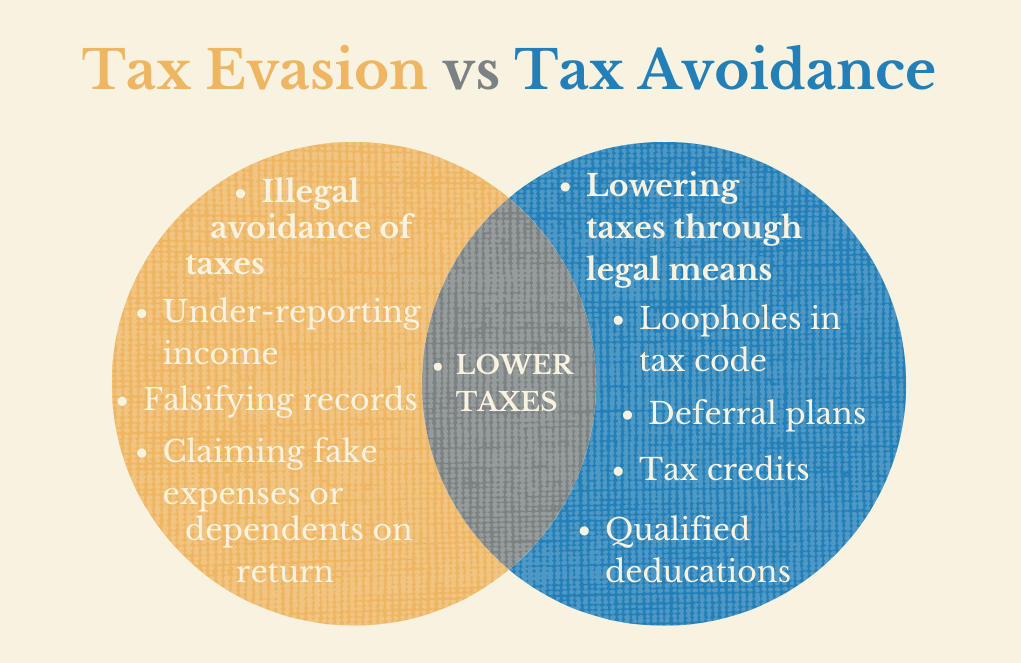

Web Activities relating to Tax Evasion. Tax evasion is illegal and can potentially get you criminally charged and sentenced to prison fined or both. Putting money in a 401 k or deducting a charitable donation are perfectly legal methods of lowering a tax bill tax avoidance as.

Web Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash. Web Tax Avoidance Tax avoidance tactics arent illegal but there are potential financial consequences involved. The first one is the evasion of assessment which includes not informing tax authorities of your exact income.

Web Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law An example of tax. Web There are mainly two types of tax evasion. Hiding interest in offshore accounts.

Inflating deductions or expenses. Web Examples of tax evasion. Tax Evasion is when a citizen tries to evade federal state and income taxes using illegal techniques.

475 29 votes For example. Tax avoidance is not illegal under any law it is a legal method to reduce the amount of tax payable by a. Web Tax avoidance is completely different from tax evasion.

This often affects people with rental properties overseas.

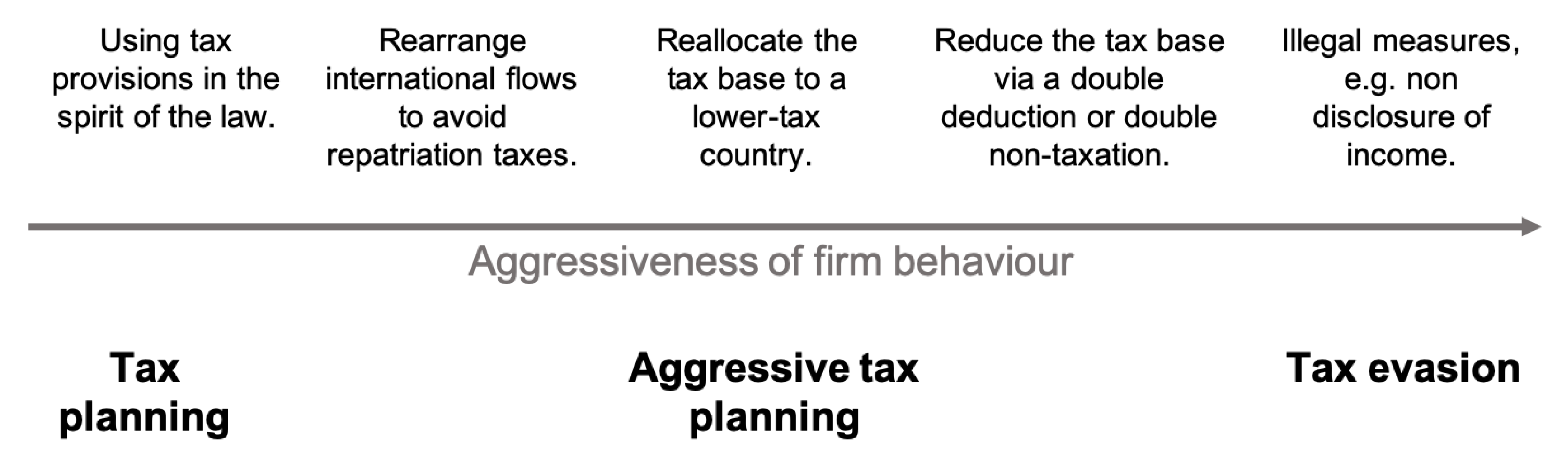

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

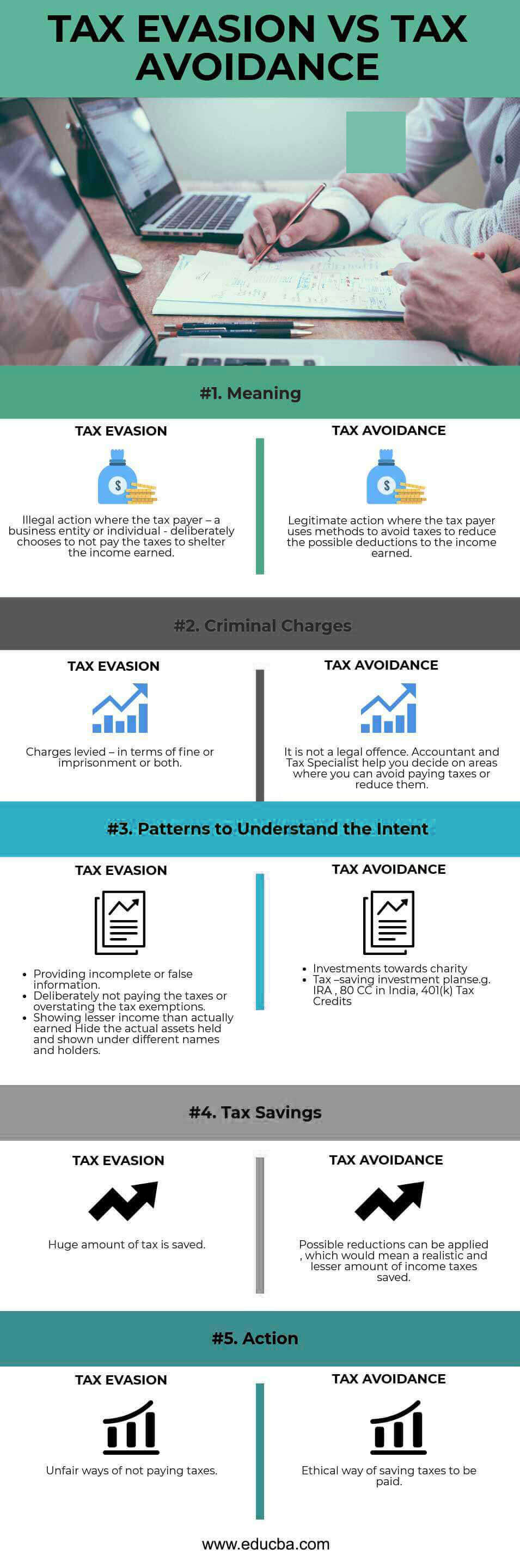

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Avoidance Vs Tax Evasion Fiscal Vocabulary Made Easy News European Parliament

Here S How You Can Legally Reduce Your Taxes If You Own A Business Globe Mybusiness Academy

What S The Difference Between Tax Avoidance And Tax Evasion Schemes

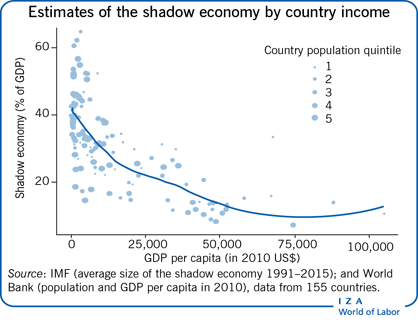

Iza World Of Labor Tax Evasion Market Adjustments And Income Distribution

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Professional Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Tax Avoidance Vs Tax Evasion Tax Executive

Tax Evasion Vs Tax Avoidance Forbes Advisor

Tax Avoidance Vs Tax Evasion What S The Difference Informi

Differences Between Tax Evasion Tax Avoidance And Tax Planning

How To Reduce Your Tax Legally And Ethically Ppt Download

Tax Evasion Vs Tax Avoidance Dsj Cpa

How Tax Evasion Vs Tax Avoidance Is Different New 2021

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

The Sources And Size Of Tax Evasion In The United States Equitable Growth